Why have a Previous Owner Exit Agreement (POEA) in place?

Today, I’m keen to draw from our experience and the experience of others when it comes to an Owner Exit Agreement or rather, Previous Owner Exit Agreement (POEA).

There is no doubt that the Merger and Acquisition space is hugely exciting. The negotiation table has been bombarded with well-intended dialogue where each party has leveraged the best possible deal. The deal has been done and the new owners now need to step up to the plate as quickly as possible but… there’s some intangible assets and liabilities lingering – let’s explore.

Previous Owner – let’s call him Nick

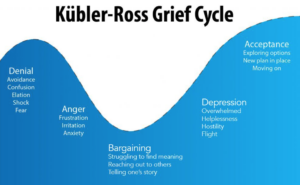

When we’ve worked with businesses, building a trusted relationship with Nick is critical. The emotions of the sale will and do come to the fore and there needs to be an acceptance that, in many ways, there is a deep sense of grief. Up until this point, Nick has been in full control of the day-to-day running of the SME business, knows where the spend and waste is, holds strong relationships with the existing team and customers. There’s much to take onboard. We liken the transition similar to KÜBLER-ROSS Grief Cycle of 5 stages, here

- Denial – Nick still runs the business

- Anger – the New CEO is doing things differently / wrong

- Bargaining – Nick is keen to provide ‘services’ himself

- Depression – there’s a sense of ‘what do I do now’, and, at some point

- Acceptance – or at least, time provides some distance.

Is there a structure you can put in place for the previous Owner?

Put simply, Yes. Efforts should be made to negotiate and agree on the Previous Owner Exit Agreement (POEA), for several reasons.

-

- Whether the new owner likes it or not, it is highly likely that the Grief Cycle will materialise, in part or in full. The duration of the cycle maybe weeks, months and in some cases it’ll continue. The characters involved will either ease the transition or not. Having a plan provides for some tangible process that the parties can sign up to.

- Generating the plan can be undertaken in-house or outsourced to consultants – we’d recommend Blueringed Consultants. Our adopted approach has been to, listen to the future plans of the previous Owner, perhaps they wish to have ‘time out’, travel, start a new venture or spend time with their family and friends. Work on that area of interest first. This’ll dedicate the timelines and can remain a constant to deliver against. In many cases, this has provided the previous owner with goals to earn their, ‘freedom’ – whatever that maybe.

- Detail the priorities, typically these are the key business functions and stakeholders, customer relations, goodwill and trade secrets, technology and team engagements. Learn from the previous Owner how things were done and how the business objectives were achieved.

- Set the rules, ie. the rules of engagement. These often come naturally as the previous Owner will be keen to be rid of the aspects of the role they’ve least enjoyed. In the rule setting, be focused on what is and isn’t acceptable.

- Timelines and Rally Cries. It is well worth focusing on 1 key deliverable at a time and crossing off the list. That way the parties can see the progress being made. One successful method has been and agreement on, ‘What can we achieve in the next 14 days?’ Deliver against that.

How long does the handover period take?

This depends on who’s taking over the role and their specific knowledge and skills of the company, sector, and industry. It’s likely with a brand new CEO flown into the role, it’ll be 6 months. For someone stepping up from within the company, it’ll be 1-3 months depending on their skill set. It sounds like a long time but, trust us, this period whizzes by.

We’d recommend that the handover period is no longer than 9 months as, in our experience, the cost-benefit quickly diminishes from the point of acquisition.

Top Tips for working through the transition exit period

- There’s a heap of emotion during the process – recognise this and know that, for the most part, it’s not personal

- Enjoy and celebrate many of the constructive and hugely insightful moments. This is very much the core of the business as an entity in itself

- Record your findings and circle back on any misunderstandings

- Develop a playbook for the team to contribute to regarding the Order to Cash process

- Do your level best to ensure that revenue streams are well protected during this period.

Top Tips for crafting a Previous Owner Exit Agreement

- If you’re the new owner, develop the draft plan first. This’ll give you insight into how you’d like matters to move forward, your standards, and your intent. Remember, it’s usually unlikely that the previous owner has had to conform in such a way before. Likewise, it’s unlikely that they’ve been given a plan before too. Be patience.

- Share your draft plan with the previous owner. Aim to build in their aspirations and timelines.

- Agree to formalise a final draft within 7 days. Make this a priority. Understand and recognise that if either party is unable to commit to this, the handover process is not likely to be easy.

- Focus on the process, not the personalities.

It’s worth remembering the Directors Duties.

Whilst this will depend on the jurisdiction the entity operates in, the IoD provides the following statement,

Statutory Duties

Directors need to be aware that they are personally subject to statutory duties in their capacity as directors of a company. In addition, the company as a separate legal entity is subject to statutory controls and the directors are responsible for ensuring that the company complies with such statutory controls.

The Companies Act 2006 codified certain common law and equitable duties of directors for the first time. The act sets out the general duties of directors, which are:

- to act within powers in accordance with the company’s constitution and to use those powers only for the purposes for which they were conferred

- to promote the success of the company for the benefit of its members

- to exercise independent judgement

- to exercise reasonable care, skill and diligence

- to avoid conflicts of interest

- not to accept benefits from third parties

- to declare an interest in a proposed transaction or arrangement.

Final thought

At any stage during the transition period and POEA remember, you’re not alone, there are experts that can support and smoothen the process. Click for support, here.

Have your say?

Given the content above, we’d be delighted to learn of your experience. Would our process have helped and supported you? In your experience, what is best practice and some of the lessons learnt whether you were the previous Owner, the acquirer, the middle manager or supporting consultant, please share your thoughts.